Edited by Simisola Fagbola, Econoday Economic Expert

The Economy

Monetary plan

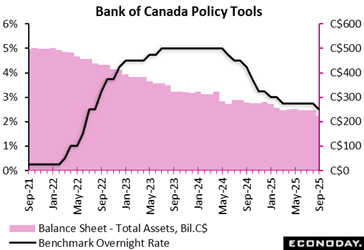

As anticipated, the Bank of Canada cut its key plan rate by 25 basis indicate 2 50 percent Wednesday, mentioning a “weak economic situation and much less upside risk to rising cost of living.”

In his declaration, Governor Tiff Macklem cited three advancements that have actually changed the equilibrium of threats given that the July 30 status quo: softening labor market problems, reducing inflationary stress regardless of combined signals, and the removal of most vindictive tolls by Canada that lower inflationary danger.

Macklem left the door open for more price cuts need to financial conditions require it, noting that the BoC will continue to “look into a much shorter perspective than normal, and be ready to respond to brand-new details.”

Going forward, the central bank still anticipates trade stress to continue to include prices despite the drag on economic task.

The plan rate had been at 2 75 percent since March, when it was decreased from 3.0 percent.

At 2 50 percent, the policy rate remains slightly over the small neutral series of 2 25 to 3 25 percent.

As the BoC proceeds “thoroughly”, its emphasis gets on threats and unpredictabilities dealing with the Canadian economic situation as it supports development while making certain inflation remains in control. The central bank also kept in mind indicators of a slowing worldwide economic climate.

On the inflation front, the BoC mentioned that the upward momentum in month-to-month core inflation has actually dissipated also as the Financial institution’s own measures remain near 3 percent. The most current inflation information indeed revealed that while heading inflation increased to 1 9 percent in August from 1 7 percent in July, two of the BoC’s own measures of core rising cost of living decreased to 2 5 percent and 3.0 percent, specifically, with the 3rd remaining steady at 3 1 percent. The standard is currently at 2 9 percent. The reserve bank estimates that, based upon wider procedures, the underlying inflation price is around 2 5 percent.

The BoC continues to carefully enjoy the effect of trade on both rising cost of living, actual and anticipated, and organization and home task.

The Canadian economy got at an annualized price of 1 6 percent in the second quarter as exports broke down. This was close to the Bank’s estimate of a 1 5 percent GDP tightening. The task market has also been quickly deteriorating, with 65, 500 tasks lost in August and 40, 800 in July. The joblessness price now stands at 7 1 percent, the highest possible given that May 2016, leaving out the 2020 and 2021 pandemic years. The BoC statement highlighted that task losses have actually been mainly focused in trade-sensitive sectors.

Looking at house spending, the reserve bank expects slow populace development and the weak point in the labor market to be a drag in months ahead.

A vital item of details missing out on is the 2025 government budget plan, which won’t be tabled until November 4 It remains to be seen how this will influence the central bank’s assessment.

In its July 30 Monetary Plan Report, the reserve bank gave 3 scenarios: In the current circumstance, Canada and China retaliatory tariffs are presumed to be permanent, while other countries are assumed to not retaliate, promoting high unpredictability into next year. After a decline in the 2nd quarter of 2025, Canada’s GDP expands by regarding 1 percent in the 2nd half of this year, with exports stabilizing and household investing recouping. GDP development accelerates to 1 8 percent in 2027 Inflation remains near 2 percent over the forecasting perspective.

Under its “de-escalation scenario”, the BoC anticipates Canada and other countries to eliminate their vindictive tolls, and unpredictability declines. GDP growth rebounds faster and rising cost of living is expected to continue to be below the 2 % target up until late 2026 Inflation would average around 2 percent in 2027

Canada’s federal government just recently chose to get rid of most retaliatory tolls on imported items from the united state, which the BoC expects to decrease higher pressure on items prices.

By contrast, under the rise scenario, Canada and China double the worth of U.S. goods subject to retaliatory tariffs, with other nations also enhancing their tariffs on the U.S. Under this circumstance, growth agreements via completion of 2025 CPI inflation is projected to come to a head at just above 2 5 % in the 3rd quarter of 2026, prior to receding to around 2 percent in 2027

Inflation

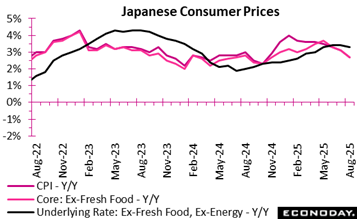

Japan’s core rising cost of living, omitting fresh food, was up 2 7 percent on year in August, matching expectations. That mirrored slower gains in prices for processed foods, which have been raised by rice supply scarcities. It additionally mirrored growing declines in power rates as a result of sustain price aids.

JAPAN AUG COMPLETE CPI + 2 7 % Y/Y, 48 TH STRAIGHT SURGE (JULY + 3 1 %); MEDIAN PROJECTION + 2 8 %

JAPAN AUG CORE-CORE CPI (EX-FRESH FOOD, POWER) + 3 3 % Y/Y, 41 ST STRAIGHT INCREASE (JULY + 3 4; TYPICAL FORECAST + 3 3 %; OVER 3 % FOR 4 MTHS IN A ROW

JAPAN AUG CPI: REFINED FOOD + 8.0% (+ 1 90 FACTOR) VS. + 8 3 % (+ 1 98 PT) IN JULY

JAPAN AUG CPI: POWER RATES – 3 3 % Y/Y (-0. 27 POINT VS. -0. 3 % (-0. 03 PT) IN JULY

JAPAN AUG CPI SOLUTIONS (EX-OWNERS’ EQUIVALENT LEASE) + 2 1 % VS. + 2 1 % IN JULY; PRODUCT (EX-FRESH FOOD) + 3 8 % VS. + 4 6 %

JAPAN AUG CPI: WAGE GROWTH STILL LAGS BEHIND HIGH COSTS FOR PROCESSED FOOD, UTILITIES, LIKELY RETAINING PRIVATE INTAKE SLUGGISH IN Q 3 GDP.

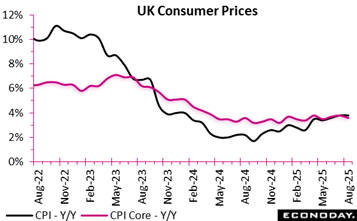

UK rising cost of living held consistent in August 2025, with the heading CPI climbing 3 8 percent year-over-year, the same from July. On a regular monthly basis, CPI increased by 0. 3 percent, mirroring in 2014’s rate. The more comprehensive CPIH step, that includes proprietor inhabitants’ real estate prices, alleviated somewhat to 4 1 percent from 4 2 percent, also tape-recording a small 0. 3 percent month-to-month surge, lower than the 0. 4 percent seen in August 2024

Air prices supplied the most significant drag out rising cost of living, softening the total numbers, while dining establishments, resorts, and electric motor fuels applied higher stress, partly balancing out the decrease. Core inflation revealed indications of cooling. Core CPI reduced to 3 6 percent from 3 8 percent, while Core CPIH slid to 4.0 percent from 4 2 percent. This recommends underlying rate pressures are easing, especially in solutions, with CPI services inflation dropping from 5.0 percent to 4 7 percent and CPIH solutions from 5 2 percent to 4 9 percent.

Item inflation, nonetheless, inched up a little from 2 7 percent to 2 8 percent, showing consistent cost stress in specific sectors. Generally, the data signals a stabilisation of rising cost of living, with services cooling down yet products revealing strength, an environment that could reduce stress on families while still positioning obstacles for policymakers seeking a definitive go back to target.

Need

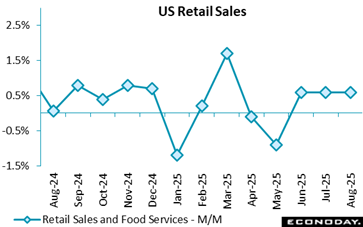

U.S. retail sales came in as more powerful than expected in August while July’s reading was modified greater. The underlying data is a variety however paints the photo of good customer costs combined with higher rates as a result of tolls boosting sales incomes. Still, sufficient customer durability for Federal Get authorities to cut– although not strongly– at this week’s FOMC meeting.

U.S. August retail sales jumped 0. 6 percent, maintaining the modified 0. 6 percent month-to-month rise reported for July (previously +0. 5 percent), and vs. the +0. 3 percent agreement in the Econoday survey of forecasters.

Core retail sales, getting rid of automobiles and fuel sales, raised 0. 7 percent last month complying with a changed 0. 3 percent analysis in July (formerly reported as +0. 2 percent). Core retail sales are up 5 4 percent on a yearly basis in August contrasted to a 4 6 percent y/y enter July.

Auto sales increased 0. 5 percent in August, complying with July’s 1 7 percent rise, and are up 5 6 percent vs. in 2015. Task proceeds its recuperation as customer need for budget friendly car choices as rates for brand-new and used vehicles remain raised.

Sales were up 1 percent for clothes stores, +0. 8 percent for showing off products, and a 0. 3 percent increase in both electronic devices and grocery sales– all fields where higher tolls have actually filtered through to prices. Even furnishings shops and various shop sellers, despite a monthly dip in sales, saw a 5 2 percent and 10 7 percent spike, respectively, compared to the same month a year earlier.

Shopping sales increased by 2 percent increase in August from +0. 6 percent in July, and they are 10 1 percent higher than a year earlier. This is an additional tariffs-impacted market, where increased costs complying with the elimination of the de minimis exemption for imported goods listed below $ 800 has most likely blew up sales numbers.

Compared to a year back, August retail sales are up 5 percent, compared to July’s 4 1 percent jump.

Omitting fuel, retail sales enhanced 0. 6 percent, after July’s 0. 6 percent rise, and jumped 5 5 percent from August 2024 vs. + 4 6 percent on an annual basis in July.

Stripping out acquisitions of motor vehicles and components, sales rose 0. 7 percent compared to a 0. 4 percent rise (formerly +0. 3 percent) in July. On an annual basis, retail sales ex-autos are up 4 9 percent, accelerating from July’s 3 9 percent pace.

Manufacturing

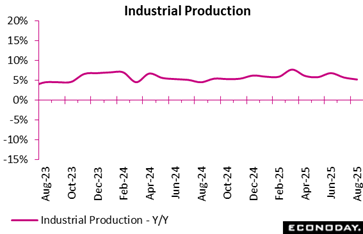

Chinese commercial manufacturing increased 5 2 percent on the year in August, reducing from growth of 5 7 percent in July and below the consensus projection of 5 6 percent. In month-over-month terms, commercial production rose 0. 37 percent in July, little transformed from a boost of 0. 38 percent in July.

Within the industrial industry, manufacturing output rose 5 7 percent on the year in August, also regulating from an increase of 6 2 percent in July. Energies result and mining outcome increased 2 4 percent and 5 1 percent on the year specifically, after previous increases of 3 3 percent and 5.0 percent specifically.

In their declaration accompanying regular monthly data published today, officials qualified the data as revealing the economy “kept a typically steady momentum with constant development” regardless of “unsteady and uncertain consider external atmosphere”. Officials repeated their dedication to carry out existing macroeconomic plans however supplied no certain advice regarding whether additional adjustments to plan settings will be taken into consideration in the near-term. Information released today were weak than consensus forecasts.

US Review

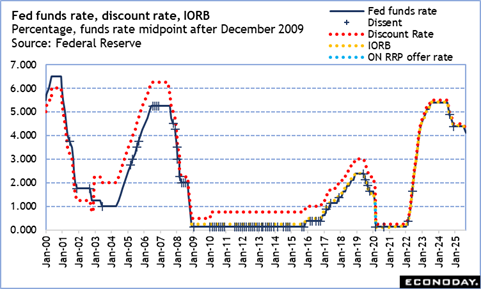

FOMC Supplies As-Expected 25 BP Price Cut, 11 – 1

By Theresa Sheehan, Econoday Economist

Going into the September meeting, there were inquiries regarding who would certainly be voting. Governor Lisa Chef won her legal challenge and was there and voting. The vacant seat on the Board of Governors was filled in brief order with the confirmation of Stephen Miran on September 15 and his swearing in before the meeting began on the 16 th Hence, the vote included a full complement of 12 citizens.

The FOMC conference of September 16 – 17 resulted in a 25 -basis factor rate reduced as expected. The conference declaration tried to balance the raised dangers to maximum work versus the halt in progress in bringing inflation down. Conditions have tipped toward the work side of the twin required requiring more support with elimination of some financial policy constraint. Nonetheless, that does not mean that the inflation information is not obtaining interest.

Only Miran dissented in the ballot, preferring a 50 -basis point cut. The skeptics at the previous conference– Guv Christopher Waller and Vice Chair for Guidance Michelle Bowman– elected with the majority this moment, probably because the agreement was that it was time to pick up the pace over the next two meetings.

In his post-meeting press rundown, Fed Chair Jerome Powell kept in mind that presently there is not course for financial plan that does not involve threat. The FOMC sees the base-case for rising cost of living as one in which existing higher rate pressures on goods from the charge of higher tariffs as of brief period. Powel said that so far the pass-through of greater costs to the consumer level has actually been smaller sized and is taking longer than previously thought. Yet he also claimed that the cost boosts will get to consumers one way or another.

Nevertheless, the United States economic situation has actually up until now stayed clear of economic crisis with strong consumer costs. The labor market is adjusting to both lessened labor supply– mostly from immigration plan– and a pullback in working with as services browse unclear problems.

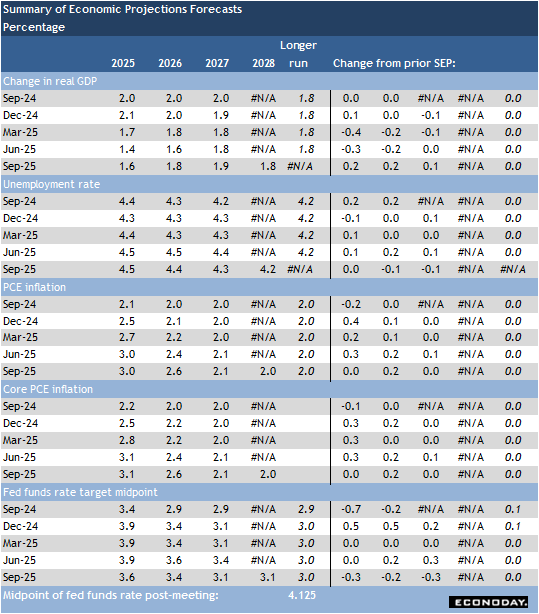

What was somewhat unforeseen is that the summary of economic forecasts did not see a lot in the way of alterations from the June edition and alterations were little. That the forecast for 2025 GDP was modified up two-tenths to up 1 6 percent was a shock, in addition to little upgrades to development forecasts for the following 2 years. The was no alteration for the projection of the joblessness rate to end 2025 at 4 5 percent, and projections for the following two years were changed higher by only one-tenth. There was no alteration to the PCE deflator projections of up 3.0 percent and up 3 1 at the core. Rising cost of living projections for 2026 were up a little bit, however still mirroring a descending trend for inflation.

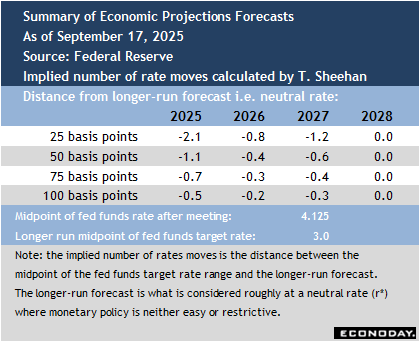

The most favorable information for financial markets was that the mid-point for the fed funds target range is modified to 3 6 percent from 3 9 percent in the June projection. This establishes 2 25 -basis factor rates cuts for the October 28 – 29 and December 9 – 10 FOMC conferences.