Edited by Simisola Fagbola, Econoday Economic Expert

The Economic situation

Monetary plan

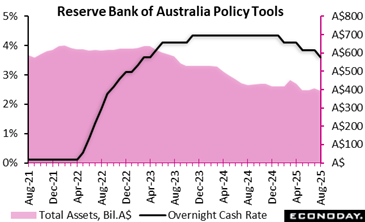

The Reserve Bank of Australia reduced its main plan price, the money price, by 25 basis factors from 3 85 percent to 3 60 percent at its meeting today, according to the consensus forecast. This rate was left on hold at the RBA’s previous conference in July after it was cut in April. The rate choice accompanied the publication of upgraded economic projections in the quarterly Declaration on Monetary Plan.

In the statement coming with the decision, authorities indicated current decreases in inflation and noted upgraded team forecasts showing that underlying rising cost of living will remain to modest to around the navel of the target variety of 2 percent to three percent. In spite of continuous tightness in the labour market, authorities noted that uncertainty over worldwide profession stress stand for a danger to family and company costs.

Showing these considerations, authorities concluded that a price cut was called for today but they additionally worried that the remain cautious regarding the outlook. They again kept in mind that monetary policy is well positioned for them to “respond decisively” if exterior aspects consider on residential economic problems.

The decision that a price cut is required reflects the truth that authorities remain confident about the inflation outlook. Heading inflation is still anticipated to be 3.0 percent at end- 2025 and 3 1 percent at mid- 2026, with completion- 2026 forecast revised up a little from 2 8 percent to 2 9 percent. The forecast for the trimmed mean measure of rising cost of living at end- 2026 continues to be the same at 2 6 percent. Both actions of rising cost of living are forecast to be at 2 5 percent mid- 2027, down from 2 6 percent formerly.

Officials have also changed down their development projections. Australia’s economy is now anticipated to expand by 1 7 percent on the year in the 3 months to December 2025, below 2 1 percent previously, and by 2 1 percent in the 3 months to December 2026, down from 2 2 percent formerly.

Inflation

July’s United States consumer price rising cost of living reading is benign externally however contains signs below of the anticipated inflationary impacts of greater tolls. For instance, rates for furniture, photographic tools, lorries increased on a month-to-month basis at the fastest price since April or May. Nonetheless, the fact that the effect is not much more widespread could enable the Fed better self-confidence to lower interest rates in September.

The Consumer Price Index in July slowed down to +0. 2 percent, complying with a 0. 3 percent surge in June, and a 0. 1 percent uptick in May. The July CPI reading matches expectations for a 0. 2 percent surge in the Econoday survey of forecasters. This marks a return to the slower month-to-month speed of overall customer price inflation seen in between February and May.

Over the last 12 months, consumer rates are up 2 7 percent, matching the 2 7 percent year-over-year surge in June. Assumptions in the Econoday survey were for a 2 8 percent increase.

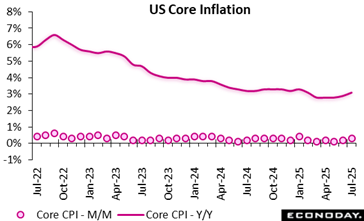

Core CPI, omitting food and power rates, is up 0. 3 percent, after increasing 0. 2 percent in June, and +0. 1 percent in May. Customer costs much less food and power jumped 3 1 percent from July 2024, following a 2 9 percent year-over-year increase in June, and 3 percent anticipated in the Econoday survey.

After increasing by 0. 2 percent in June, shelter costs increased by 0. 2 percent in July (and are up 3 7 percent year-over-year). Food rates were level, after a 0. 3 percent jump in June, with grocery store prices down 0. 1 percent last month, and restaurant costs rising 0. 3 percent.

Energy prices acquired by 1 1 percent over the month, complying with a 0. 9 percent spike in June– dragged down by a 2 2 percent autumn in gasoline costs.

Energy rates are down 1 6 percent year-over-year, following a 0. 8 percent dip for the 12 months ending June. Food rates raised by x percent contrasted to July 2024, following a 3 percent surge in June.

Employment

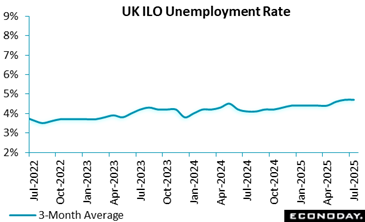

The UK labour market in mid- 2025 revealed that payrolled staff members decreased by 149, 000 throughout the years to June and a further 164, 000 by July, signalling subdued hiring momentum. While the work price for 16– 64 -year-olds increased to 75 3 percent, unemployment edged as much as 4 7 percent, recommending even more people are proactively looking for job. Economic lack of exercise fell to 21.0 percent, meaning a progressive re-entry right into the workforce.

Vacancies fell for the 37 th consecutive period, down 44, 000 to 718, 000, with many industries reporting fewer openings, reflecting feasible caution amongst companies about employment or replacement hiring. Earnings continued to expand robustly, with routine incomes up 5.0 percent and greater in the public field (5 7 percent) than in the economic sector (4 8 %), while total revenues consisting of perks, were 4 6 percent. Real pay development continued to be small at 0. 9 % (CPIH-adjusted), indicating inflation’s sticking around capture on home buying power.

At the same time, the Plaintiff Count was up to 1 695 million, using a counterpoint to softening pay-roll numbers. Nevertheless, 38, 000 functioning days were shed to labour conflicts in June, emphasizing recurring stress in pay and conditions. Overall, the data suggest a labour market in change, holding steady in employment rates yet dealing with relentless recruitment caution and wage-price pressures.

GDP

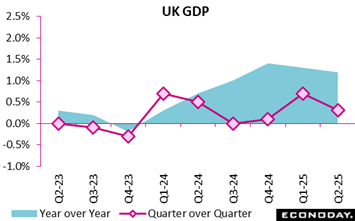

The UK economic climate preserved its growth trajectory in the second quarter of 2025, with GDP rising by 0. 3 percent, following a stronger 0. 7 percent growth in the initial quarter. Compared to the exact same period in 2024, GDP expanded by 1 2 percent, mirroring consistent but regulating momentum.

In output terms, services, the UK’s dominant sector, broadened by 0. 4 percent, while construction posted durable growth of 1 2 percent, underscoring durability in framework and building activity. Nevertheless, production gotten by 0. 3 percent, highlighting continued stress in production and related industries.

Actual GDP per head expanded by 0. 2 percent in the quarter, and by 0. 7 percent year-over-year, indicating that result gains were small once population development was factored in. Importantly, no modifications were made to formerly published GDP figures, with more extensive data updates arranged for August and September 2025 under the National Accounts Revisions Plan.

On the whole, the second quarter efficiency indicate a stable, service-led economic climate strengthened by building and construction, but toughened up by weak point in manufacturing.

Need

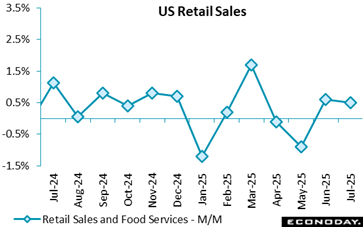

United state retail sales came in as expected in July while June’s reading was revised greater. The underlying information is a variety, with tightenings in some sectors with an exposure to tolls, but sufficient costs durability in groups like autos, along with division and furnishings stores. Sufficient consumer strength for Federal Get officials to stay patient concerning the timing of the following price cut.

United state July retail sales leapt by 0. 5 percent, building on the revised 0. 9 percent monthly surge reported for June (previously +0. 6 percent), and as expected by the consensus in the Econoday study of forecasters.

However, core retail sales, getting rid of autos and gasoline sales, just raised 0. 2 percent last month adhering to a modified up 0. 8 percent reading in June (formerly reported as +0. 6 percent). Core retail sales are up 4 4 percent on an annual basis in July compared to a 4 6 percent y/y enter June.

Vehicle sales rose 1 7 percent in July, complying with June’s 1 6 percent boost, and are up 4 9 percent vs. last year. Task continues its recuperation after decreasing complying with the pre-tariffs spike in March.

Summer costs is solid, however there sales got in industries with exposure to greater tolls. Building materials, yard equipment and providers’ sales dropped 1.0 percent in July, electronic devices and appliances were down 0. 6 percent, and various shop merchants saw a 1 7 percent contraction.

Ecommerce sales slowed a little to a 0. 8 percent boost in July from +0. 9 percent in June, and they are 8.0 percent more than a year ago.

Compared to a year earlier, July retail sales are up 3 9 percent, compared to June’s 4 4 percent dive.

Leaving out fuel, retail sales raised 0. 5 percent, after June’s 0. 9 percent boost, and leapt 4 5 percent from July 2024 vs. + 5.0 percent on a yearly basis in June.

Stripping out purchases of car and components, sales rose 0. 3 percent compared to a 0. 8 percent boost (formerly +0. 5 percent) in June. On an annual basis, retail sales ex-autos are up 3 7 percent, a small slowdown from June’s 3 8 percent rate.

Belief

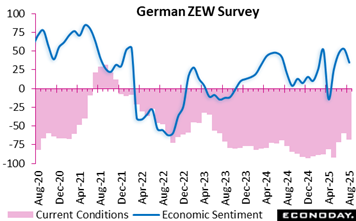

Germany’s economic state of mind darkened in August 2025, with the financial sentiment sign plunging to 34 7, down 18 points from July. This notes a break in the months-long higher pattern, showing growing anxiousness amongst monetary market professionals. The present scenario assessment glided better into unfavorable territory at minus 68 6, driven by weak 2nd quarter efficiency and sector-specific stress.

The just recently announced EU– United States trade offer, instead of increasing self-confidence, triggered dissatisfaction. Problems centre on its restricted benefits for key German sectors, especially chemicals, pharmaceuticals, mechanical design, steels, and vehicle, already coming to grips with restrained need.

The more comprehensive eurozone overview mirrored Germany’s decline. Financial sentiment was up to 25 1, a decrease of 11 factors, with the existing scenario index declining to minus 31 2 Downward modifications to growth assumptions highlight that the slowdown is not confined to Germany however expands throughout the financial union.

Fundamentally, August’s outcomes expose a vulnerable recuperation eclipsed by profession deal apprehension, relentless industrial headwinds, and a softening eurozone expectation, suggesting of cautious optimism giving way to renewed problem.

Company Surveys

US Testimonial

CPI and PPI-FD Program Import Price Pressures Climbing

By Theresa Sheehan, Econoday Financial Expert

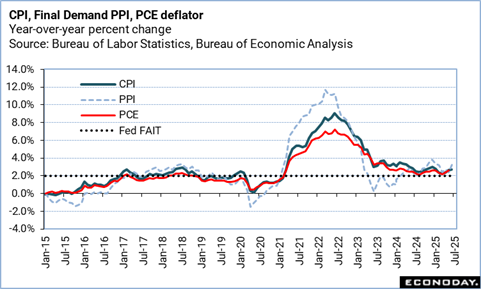

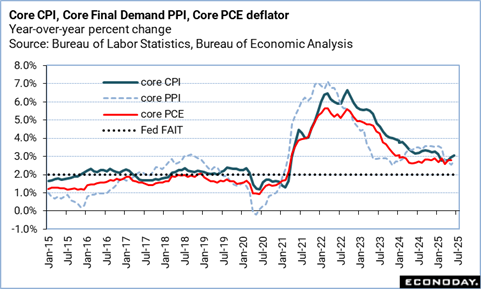

The customer rate index (CPI) and final-demand manufacturer price index (PPI-FD) for July both suggest that rate stress are beginning to swing greater. Digging through the data, it is relatively clear that costs are increasing in categories connected to imports. New tariffs and subsequent efforts by companies to recoup the expenses are becoming extra noticeable. It is much less evident in the July CPI numbers, however the PPI indicate increasing prices at the customer degree in coming months.

This is not unforeseen. What continues to be in question is just how much of the costs will customers be asked to pay, exactly how huge those prices are, and the length of time will it take to pass through the rising cost of living data? Upward price pressures appear for commodities and solutions, and are broad-based. Nonetheless, it remains in the food and power categories that consumers are most likely to feel the best pain.

If costs for food were unmodified in the CPI index for July from June, the PPI for last need foods is up 1 4 percent. The CPI for power was down 1 1 percent in July from the prior month, yet the PPI power index reveals a 0. 9 percent rise. These products have a direct and instant impact on household incomes and costs.

The solutions utilized by families are numerous and differed. The impact of rate changes is more challenging to analyze out. However, service companies usually have little choice but to pass on expenses to clients. The CPI for all services was up 0. 3 percent in July, while the PPI for last demand services is up 1 1 percent. A few of this is likely to appear in transport where traveler carriers and shippers commonly enhance charges to move goods and supply services.

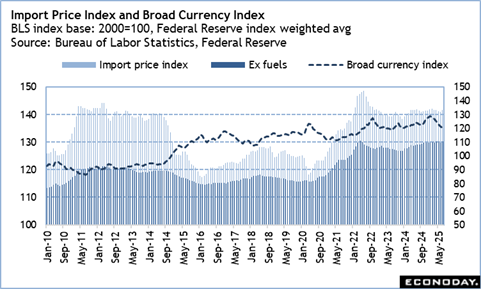

The import consumer price index for July shows a 0. 4 percent increase from the prior month, although it is down 0. 2 percent year-over-year. The index for imported fuels– which are priced in US bucks– is up 2 7 percent in July, and down 12 1 percent year-over-year. The import price index for nonfuels is up 0. 3 percent in July and 0. 9 percent more than a year back. Partly, the weaker US buck versus a wide basket of money suggests imports are obtaining more costly.