Edited by Simisola Fagbola, Econoday Financial Expert

The Economic climate

Monetary policy

The Swiss National Bank made a decision not to push rates right into negative territory following its September conference, leaving the rate on view down payments which banks keep at the SNB at 0.0 up to an identified threshold. The price cut rate for view deposits over the limitation was held at 0. 25 percent.

Switzerland’s reserve bank likewise especially pointed out United States tolls, keeping in mind the global economy is being hindered by the levies. A high level of unpredictability remains which obstacles could as a matter of fact be elevated better. Still, the SNB said the worldwide economic climate might offer even more resiliency than prepared for.

For the Swiss economy specifically, tariffs are the major risk, likely even more wetting exports and investment, with watchmakers and manufacturers of machinery especially hard struck. The services sector has been primarily saved, which should assist the economic climate to remain secure amidst some modest development. The SNB is anticipating growth in between 1.0 to 1 5 percent this year and slowing down to 1.0 percent following year.

The Swiss franc continues to be strong, with the SNB stating it wants to continue to be active in the forex markets. One option available to aid alleviate the toll influences are cheapening the Swiss franc, although that would certainly make imports much more pricey. However, with rising cost of living currently controlled, it’s certainly a choice for the SNB. This year, rising cost of living is expected to be 0. 2 percent, increasing to 0. 5 percent in 2026, and raising once more in 2027 to 0. 7 percent.

Today’s decision reveals a mindful SNB evaluating its alternatives and seeing just how conditions develop around tariffs. In the United States, an appeals court upheld the choice of a trade court proclaiming most of the tariff’s prohibited. That is expected to get to the US Supreme Court in October or November which is prior to the regulating board reunites in December to choose rates.

Inflation

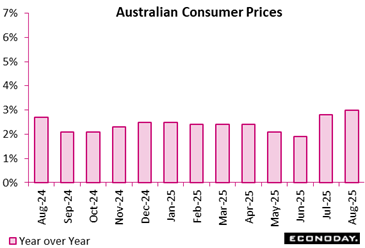

Monthly Australia CPI information reveal heading rising cost of living increased from 2 8 percent in July to 3.0 percent in August, simply above the agreement forecast of 2 9 percent, with yearly electrical power cost raises the primary element pushing up heading inflation. Heading inflation has now been within the Get Financial institution of Australia’s target variety of two percent to 3 percent for thirteen consecutive months however is now at its highest degree for this duration. This monthly indication determines the year-over-year modification in the CPI index compared to the same month twelve months previously.

The boost in headline inflation in July was greatly driven by power costs, up 24 6 percent on the year after a previous increase of 13 6 percent. This boost reflects the effect of rebates paid last year. Excluding this effect, electrical power prices increased 5 9 percent on the year. Automotive gas rates fell 1 7 percent on the year after a previous decrease of 5 5 percent while food rates rose 3.0 percent on the year, as they did formerly. Hidden steps of rising cost of living showed mixed results, with the cut mean procedure reducing from 2 7 percent to 2 6 percent, and the action leaving out volatile items and holiday travel grabbing from 3 2 percent to 3 4 percent.

At their most recent plan conference last month, the RBA reduced plan rates by 25 basis points, with authorities encouraging that they expect heading rising cost of living to pick up somewhat later this year but then drop back to around the mid-point of their target variety of 2 to 3 percent. The minutes of the conference released previously this week additionally revealed that authorities anticipate to lower rates better however are uncertain concerning the most likely rate of plan easing. With the rise in heading inflation reported today mostly driven by the impact of discounts, this may be marked down when authorities analyze whether an additional price cut is called for at their conference following week.

Employment

The pace people yearly core PCE price rising cost of living has been stuck at just under 3 percent because May– stubbornly refusing to make any further progress in the direction of the Federal Book’s 2 percent inflation purpose. That, in addition to the solid rate of customer costs, emphasizes the raised unpredictability around the outlook for monetary plan, and why Fed Chair Jerome Powell’s cautioned today about the advantage near-term dangers to rising cost of living.

United state personal earnings increased 0. 4 percent in August, matching the price of increase in July and over assumptions for a 0. 3 percent increase in the Econoday survey of forecasters. Consumer spending, as determined by the Personal Consumption Expenses (PCE) index, jumped 0. 6 percent last month, adhering to an unrevised 0. 5 percent surge in July. Increased costs on goods (+0. 8 percent) was improved by the August 11 extension of the Trump management’s time out on punishing tariffs on Chinese imports.

When it comes to the Federal Reserve’s preferred inflation gauge, the PCE consumer price index was up by 0. 3 percent on a month-to-month basis in August, getting the pace from the 0. 2 percent uptick in July and complying with a 0. 3 percent increase in June.

Prices for items saw a 0. 1 percent rise and costs for services raised 0. 3 percent. Food rates leapt 0. 5 percent and power costs rose 0. 8 percent. Leaving out food and power, the PCE price index was up 0. 2 percent, adhering to a 0. 2 percent boost in July.

Compared to a year earlier, the August PCE consumer price index increased 2 7 percent, accelerating from a 2 6 percent year-over-year surge in July. Costs for products are up 0. 9 percent, and the price of services leapt 3 6 percent. The core PCE consumer price index is up 2 9 percent from August 2024, matching the rate set in July.

Expectations in the Econoday study were for a 0. 3 percent month-to-month increase and a 2 7 percent surge on an annual basis.

Company Studies

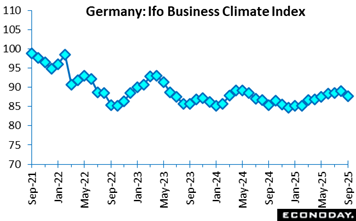

Germany’s September 2025 total Ifo business environment index dropped to 87 7, well listed below both the agreement (89 1 and the previous month’s 89.0. This sharp autumn signals that optimism is sliding faster than prepared for, with companies noticing headwinds rather than recovery.

The decline comes from weak point in both present activity and future overview. Current problems eased to 85 7 versus expectations of security at 86 4, suggesting that firms are already grappling with fragile need and persistent price stress. More striking is the damage in company expectations, which was up to 89 7 from 91 6, missing out on projections of 91 7 This gap shows growing unease concerning Germany’s near-term prospects amidst slow-moving worldwide profession, power uncertainty, and ongoing geopolitical stress.

Taken with each other, the most recent upgrade implies that self-confidence is damaging across the business landscape. German companies are not just really feeling the heat however likewise supporting for more tough times ahead. Unless exterior conditions improve or domestic plan assistance strengthens, momentum in Europe’s industrial powerhouse dangers slipping further into contraction territory.

Germany’s composite PMI rose to 52 4, its highest in 16 months and 2 3 factors above the agreement, signalling growth energy. This was mainly driven by the solutions field, which recovered highly to 52 5 after slipping in August. Manufacturing, nevertheless, slid additionally into contraction at 48 5, pointing to fragility in commercial task. While output increased, brand-new orders fell across both fields, with suppliers reporting their sharpest decrease popular because January and a second month of dropping export sales. Services remained to rely on backlogs, which have been gradually depleting for greater than a year.

Work market problems weakened additionally, with work diminishing for a sixteenth successive month, specifically in production. Climbing price pressures complicated the photo, as input and output inflation both increased to multi-month highs, led by services. Although business expectations remained in favorable area, self-confidence slipped below the long-run standard, mirroring problems regarding slow development, persistent unpredictability and raised expenses.

Undoubtedly, the information recommends that while Germany has restored some development energy, it stays underpinned by weak need, decreasing employment and fragile self-confidence, leaving its healing susceptible to renewed headwinds.

United States Testimonial

Lower Mortgage Rates Lift Housing Sector

By Theresa Sheehan, Econoday Financial Expert

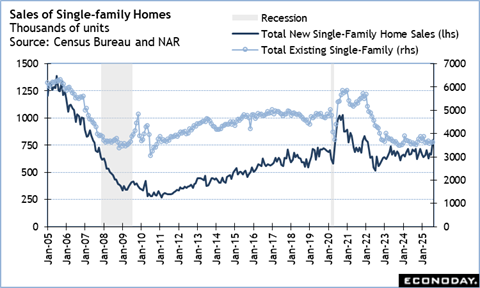

It appears that the recent decreases in home loan prices will certainly provide an increase to the real estate market in the close to term. Nevertheless, the burst of activity can swiftly sap what little bit pent-up need there is. Several prospective homebuyers are worried about the direction of the United States economic climate, rising rates on important items in house budget plans, and broader job protection. The sales rate might steady, although it is most likely to continue to be soft.

August sales of existing single-family homes– to consider the numbers outside the unpredictable multi-unit field– are down a minor 0. 3 percent to 3 63 million units at a seasonally changed yearly price contrasted to 3 64 million devices in July. Nevertheless, sales of existing homes are for agreements closed and mainly show mortgages obtained in the prior month.

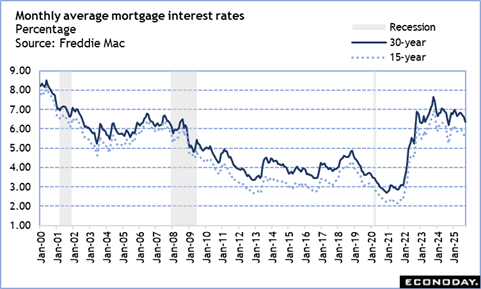

The Freddie Mac typical rate for a 30 -year taken care of rate home loan dropped from 6 82 percent in June to 6 72 percent in July. This is a moderate renovation yet still near sufficient to the 7 -percent mark that customers typically opted for adjustable-rate mortgages. July coincides with the beginning of the annual trend for the mean rate for an existing home to fall after coming to a head in June, and lower costs can tempt some customers. The closing price of an existing single-family home decreases 1.0 percent in August to $ 427, 800 from $ 432, 000 in July. The rate is up 4 5 percent compared to a year earlier. Home rates remain to appreciate on an annual basis although the rate has alleviated.

Sales of new single-family homes leap 20 5 percent to 800, 000 in August after 664, 000 in July and are up 15 4 percent contrasted to a year back. Buyers moved quickly to authorize agreements for new construction while the September Freddie Mac average price for a 30 -y 6 ear taken care of rate home mortgage went down to 6 35 percent. The price is one that improves the price of a home purchase and can lead buyers to choose a larger unit than formerly prepared. Brand-new building is typically more costly than existing units. The 4 7 percent rise in the mean rate for a new home at $ 413, 500 in September from $ 395, 100 in July is probably more from buying of pricier systems than an extensive gain in costs. The year-over-year rise is 1 9 percent as products of new homes stay relatively plentiful and encountering competition from increased supplies of existing systems.