Modified by Simisola Fagbola, Econoday Economist

The Economy

Monetary policy

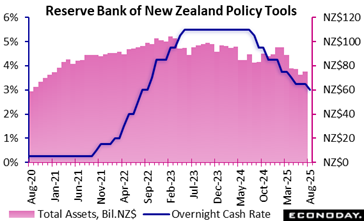

The Get Financial Institution of New Zealand’s Monetary Policy Board has reduced the main cash money price by 25 basis indicate 3 00 percent, in line with the agreement projection. Authorities have decreased plan prices by an advancing 250 basis points over their previous 8 conferences after an extended period of restrictive policy settings.

In the declaration going along with the decision, officials noted that rate stress are regulating and expressed confidence that rising cost of living is most likely to go back to around the center of their target variety of 1 percent to 3 percent by mid- 2026 Although they anticipate residential growth will be supported by previous policy easing, they warned that international uncertainty and weak home rates may reduce the rate of financial healing.

Reflecting this analysis, officials made a decision that that it was suitable to cut plan prices once more today. They also recommended that if medium-term rising cost of living stress reduce as they anticipate, they will likely reduce the cash money price better in coming meetings.

Rising cost of living

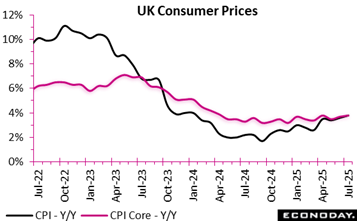

The July 2025 UK inflation record reveals a moderate however notable upward activity in customer rates. CPI climbed to 3 8 percent each year, compared with 3 6 percent in June and 0. 1 percent over the agreement projection, driven mostly by transportation costs, especially air prices, which included higher pressure. Nevertheless, this was partially balanced out by real estate and home solutions, particularly proprietor inhabitants’ housing expenses, which maintained CPIH rises relatively consisted of.

On a monthly basis, CPI inched up by 0. 1 percent, contrasting with a fall recorded a year earlier, signalling firmer rate energy.

Core rising cost of living remained sticky, with CPI at 3 8 percent and CPIH at 4 2 percent on a yearly basis, showing relentless demand-side stress beyond unpredictable power and food. Product rising cost of living picked up slightly, while solutions rising cost of living continued to be more powerful, with CPI solutions climbing to 5.0 percent and CPIH services holding constant at 5 2 percent.

These numbers indicate that while inflationary pressures are not speeding up greatly, underlying price dampness in services might complicate the path toward stabilisation. Undoubtedly, July’s information suggest that the equilibrium in between transport-driven price rises and housing-related relief remains breakable, pointing to the need for continued alertness in financial and fiscal policy reactions.

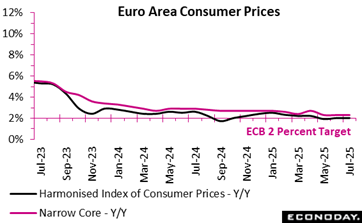

Euro location rising cost of living held consistent at 2.0 percent in July 2025, unchanged from June yet notably lower than the 2 6 percent videotaped a year previously, mirroring a steady alleviating in cost stress. Over the month, however, there were no modifications in the rising cost of living numbers within the area, showing stability.

Provider remained the leading motorist, including 1 46 percent points to the heading price, underlining relentless expense pressures in labour-intensive markets. Food, alcohol and cigarette added an additional 0. 63 points, showing that homes remain to face elevated grocery bills. Non-energy commercial products included 0. 18 factors, suggesting moderate rate gains in manufactured things. By comparison, power put in a negative contribution (minus 0. 23 points), reflecting reduced gas and energy prices that helped counter higher pressure elsewhere.

Underneath the security, inflation dynamics differed across participant states: eight nations saw declines, 6 held steady, while thirteen experienced an uptick, signalling irregular progression in cost security throughout the bloc. Across the leading four economic climates in the location, inflation dropped in Germany (1 8 percent after 2.0 percent) and Italy (1 7 percent after 1 8 percent), but increased in Spain (2 7 percent after 2 3 percent), while it continued to be constant in France (0. 9 percent after 0. 9 percent) on a yearly basis.

As a result, the total image recommends that while heading rising cost of living has returned to the European Central Bank’s 2 percent target, the make-up indicate persistent service-sector rising cost of living.

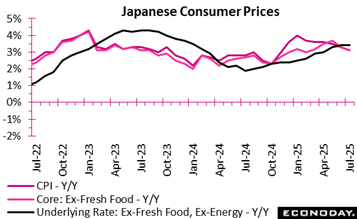

Japan CPI: All as expected, high inflation is injuring homes whose major rice earners see actual earnings succumb to the 7th straight month in June (modified work study contemporary– overall regular monthly ordinary cash money earnings per regular staff member were up 3 1 % vs first + 2 5 % however incomes after adjusted for rising cost of living slid 0. 8 % vs. prelim – 1 3 %)

— Consumer rising cost of living in Japan reduced better in July to simply above 3 % in 2 key steps, many thanks to retail fuel subsidies which has balanced out the continued uptick in refined food prices. The yen’s rise from in 2015’s slump has additionally decreased import expenses and triggered a pullback in investing by visitors from overseas that shed their money’ one-upmanship over the yen.

— The core reading (leaving out fresh food) uploaded a 3 1 % surge on year in July after its yearly price decelerated to 3 3 % in June from 3 7 % in May. The year-on-year surge in the overall CPI likewise regulated to 3 1 % from 3 3 % in June and 3 5 % formerly. The underlying inflation gauged by the core-core CPI (excluding fresh food and energy) stood at 3 4 % after rising to a 17 -month high of 3 4 % from 3 3 %.

— The influence of slowing total energy rate gains (gas has been down) was mitigated by raised refined food rates in spite of gradually easing residential rice supply scarcities. Regular rice prices increased as high as 90 % y/y but that is somewhat less than over 100 % (dual) earlier this year. The rates of delicious chocolate stay high, up 51 %, while those of coffee beans climbed 44 %.

Takeaway:

The current high inflation rate is not totally backed by domestic need (wage-heavy solutions cost hikes hang back goods price gains) but mainly pushed up by greater import expenses. This implies that rising cost of living in Japan is not come with by continual and significant wage growth which underlying inflation, approximated by the Financial institution of Japan to be around 1 5 %, simply below the bank’s 2 % cost security target. The bank remains in the procedure of normalizing its policy stance after a decade-long large-scale easing period via 2022 and is set to proceed gradually elevating the over night rate of interest from the existing level of 0. 5 %. Officials suggest that real borrowing costs continue to be “significantly unfavorable” since the BOJ has actually bewared regarding increasing rates even when rising cost of living expectations are rising moderately.

GDP

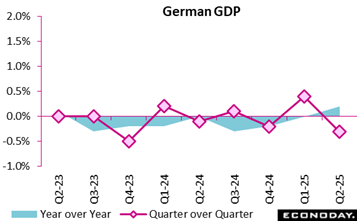

Germany’s economic situation slid back right into tightening in the 2nd quarter of 2025, with GDP falling by 0. 3 percent from the previous quarter and 0. 2 percent less than the same duration a year earlier (price and seasonally readjusted). Changed numbers show that weaker-than-expected industrial result, paired with a sharp downturn in building and construction (minus 3 7 percent), dragged development right into unfavorable territory.

Home intake supplied little relief, edging up by simply 0. 1 percent, while government spending (0. 8 percent) was the only remarkable residential support. Capital formation suffered a significant obstacle, particularly in equipment (minus 1 9 percent) and construction financial investment (minus 2 1 percent). External trade intensified the weak point, as exports decreased (minus 0. 1 percent) and imports surged (1 6 percent).

On a yearly basis, family and federal government consumption gave modest development (1 2 percent and 2 1 percent), yet this was surpassed by high decreases in investment and goods exports minus 3 6 percent). Work remained secure at 46 million, however performance gains were irregular, showing minimized hours functioned. The cost savings ratio dropped to 9 7 percent as consumption expanded faster than revenues.

Contrasted worldwide, Germany’s efficiency hung back Spain (0. 7 percent), France (0. 3 percent) and the US (0. 7 percent), highlighting its fragile recuperation. Overall, the most up to date upgrade demonstrate an economic situation bore down by weak industry, reducing investment, and worldwide profession headwinds, with intake alone preventing a much deeper recession.

International trade

Japan trade data:

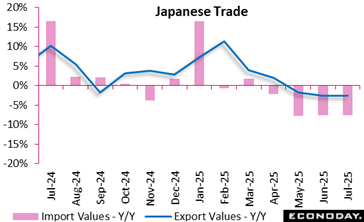

— Japanese export values – 2 6 %, the third straight y/y decrease in July -0. 5 % in June and – 1 7 % (the first decline in eight months) in May. Japanese carmakers are minimizing the rates for united state consumers to cover high Trump import tariff expenses, putting in descending pressures on total export costs, but the volumes of Japan’s exports to the world stay on an uptrend. The decline in July export values was led by autos, iron/steel and automobile components.

— Import worths – 7 5 % after noting an unexpected surge in June (+0. 3 %) and plunging 7 6 % in May. The decline was driven by reduced rates for crude oil, coal and melted natural gas.

— The trade equilibrium: a deficit of ¥ 117 55 billion vs. a downwardly revised ¥ 152 12 billion excess in June (the initial black ink in 3 months) and a ¥ 628 34 billion shortage recorded in July 2024

— Exports to the USA – 10 1 % y/y, the 4 th straight decline (- 11 4 % the previous month), hit by autos, vehicle components and semiconductor-producing devices; Exports to the European Union – 3 4 %, the first drop in three months (+ 3, 6 %), lowered by iron/steel, organic substances and vehicle parts; Exports to China – 3 5 % y/y, the 5 th straight drop (- 4 7 %) on slower need for vehicles, non-ferrous metals and automobile components.

United States Review

Fed’s Powell Sets Stage for Price Cut

By Theresa Sheehan, Econoday Economic Expert

Fed Chair Jerome Powell’s keynote address at the Kansas City Fed’s yearly Jackson Hole Discussion forum overshadowed the economic information for the week.

Powell set the stage for a price cut at the September 16 – 17 FOMC meeting while cautioning– yet once again– that monetary plan is not on a preset path, and that its choices are made at the conference, not previously. He claimed, “FOMC participants will certainly make these decisions, based only on their evaluation of the data and its implications for the economic overview and the equilibrium of dangers. We will certainly never ever deviate from that method.” Powell may be making an oblique reference to the dissent in the July 28 – 29 meeting vote by Guv Christopher Waller and Vice Chair for Guidance Michelle Bowman– both Trump appointees to the Board of Governors. Powell is asserting the freedom of Fed policymakers and their range from national politics.

The “tension” in between the requireds for maximum work and price stability has shifted, and the weakening in the labor market may make a price cut proper. Powell supplied a nuanced assessment of when the joblessness rate continues to be in the reduced 4 -percent variety, mainly due to labor supply falling at the exact same time labor demand is decreasing.

Powell also talked thorough concerning the risks to price security from greater tolls. “The effects of tolls on customer prices are currently clearly noticeable,” Powell claimed. He highlighted that these the effect could be “reasonably short lived” yet likewise that these will disappoint up simultaneously. Powell called this a “practical base case” for rising cost of living, however “It will continue to take time for tariff increases to function their way via supply chains and circulation networks. Furthermore, tariff rates continue to advance, potentially extending the modification process.”