&# 13;

Avoid to content

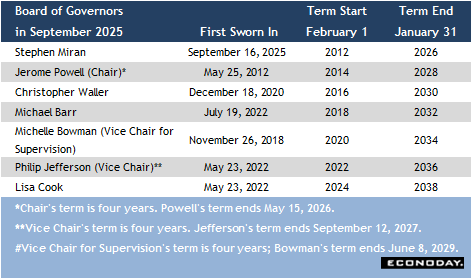

The skin tone of the September 16 – 17 FOMC conference changes with two advancements.

First is the uncommonly swift confirmation of Stephen Miran as a Fed governor and his swearing in that took place prior to the meeting began on Tuesday. Miran is selected to finish the term finishing January 31, 2026 that was left early by Adriana Kugler. It can be inferred that his time on the board will intentionally be short since his confirmation did not include a reappointment to the brand-new term when the present one runs out. This leaves Head of state Trump with the alternative nominating another person to the term beginning February 1, 2026 and running through January 31, 2040 Miran joins 2 other Trump appointees on the Board– Governor Christopher Waller and Vice Chair for Supervision Michelle Bowman.

Guv Lisa Cook has actually won her appeal to remain on the board unless and until the efforts of the Trump administration to unseat her work. Until now legal grounds for her removal are slim and unlikely to prevail.

Fed Chair Jerome Powell encounters even greater difficulties to his leadership in maintaining the professionalism and reliability and self-reliance of the central bank. In spite of the statements in his confirmation finding out about the importance of an independent Fed, Miran is maintaining his ties with the Trump management. This does not presage the disinterred stance of a monetary policymaker sworn to attempt to accomplish the twin required of rate security and optimum work. However, this is conjecture and his activities will certainly identify his tradition at the Fed.

All the same, the FOMC will certainly have a complete complement of 12 voters to set monetary policy at the end of both days of considerations.

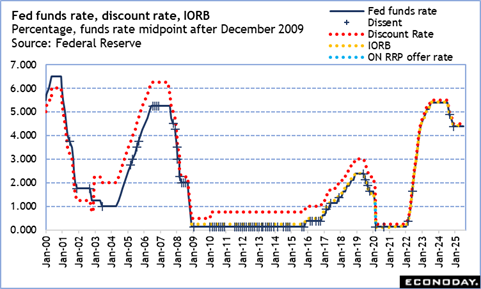

Should most of the FOMC voters favor a 25 -basis point rate reduced at this conference as is extensively expected, this increases a distinct possibility of one more dissent in the vote. At the prior meeting Waller and Bowman dissented for a 25 -basis point cut against the majority for no adjustment in the fed funds target rate variety of 4 25 – 4 50 percent. It would certainly be not a surprise if Waller, Bowman, and/or Miran favor a 50 -basis point cut at this meeting. It is not out of the realm of opportunity that, two, or all 3 would certainly choose a 75 -basis factor cut.

Should the FOMC bulk establish a 50 -basis factor rate cut is ideal, the possibility of dissenting ballots is much less, especially if the quarterly update to the recap of economic projections (SEP) indicates a velocity in the timeline for price cuts. The SEP projections for the United States economic situation are likely to reveal a downgrade in growth, greater unemployment, and much less development in disinflation towards the Fed’s 2 percent inflation target. The SEP could well mirror expectancy of cuts at the October 28 – 29 and December 9 – 10 meetings, and more right into 2026

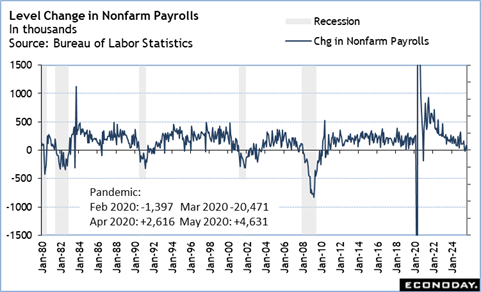

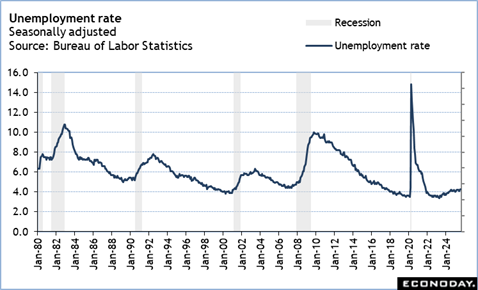

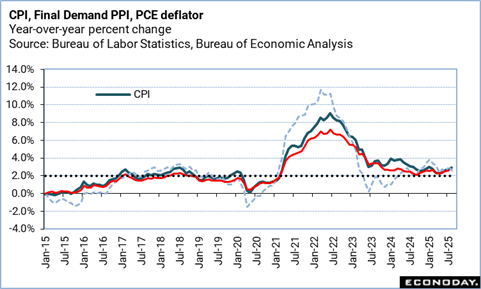

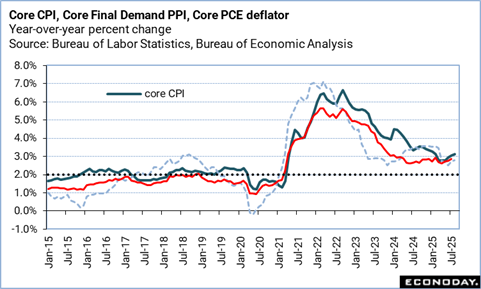

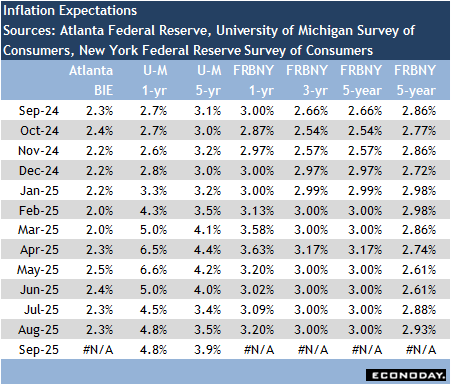

The upgraded SEP will be released at 14: 00 ET on Wednesday along with the FOMC declaration and execution note. The statement will be a careful one as the presently fragile equilibrium between achieving optimum employment and price security is starting to tip the focus more towards the weakening labor market also as inflation stays elevated and rising cost of living assumptions hesitate ahead down. Critical to the FOMC decision is how much emphasis will be put on the decrease in hiring also as joblessness has actually hardly risen versus the recent uptick in rising cost of living– mainly related to tolls and potentially of short duration– and persistently greater rising cost of living expectations for the longer term.

In his press instruction at 14: 30 ET on Wednesday, Powell will likely obtain many concerns that he can not or will certainly not respond to regarding the effect of political disturbance at the central bank and the connections in between his coworkers on the FOMC. He will, as ever before, urge that the FOMC makes its decisions solely on the basis of the available information, that no choice is made prior to the conference, which financial plan is not on a predetermined program. Nevertheless, he will be continued the FOMC consensus regarding the choice and what it means for the future course of rates of interest.

Share This Story, Choose Your System!